Dubai Real Estate Market 2025: A Record-Breaking Year

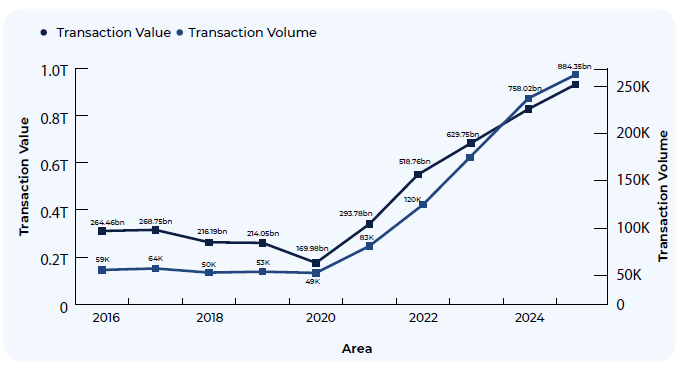

In 2025, Dubai’s real estate market entered a new phase of scale, maturity, and global relevance. The sector delivered one of its strongest performances to date, driven by record-breaking transaction activity, rising price benchmarks, and sustained investor confidence across residential, commercial, and land segments. Total real estate activity reached AED 884.35 billion, a 16.5% year-on-year increase, while transaction volumes surged to 256,906 deals. Average prices climbed to AED 1,757 per square foot, reflecting double-digit growth and underscoring Dubai’s evolution from a high-growth market into a globally competitive investment destination aligned with institutional standards. Supportive policies, falling interest rates, and streamlined financing further fueled end-user and investor participation across both primary and secondary markets.

Figure 1: Dubai Real Estate Market: Total Transaction Volume and Value (AED billions), 2016–2025

“Over the last decade, Dubai’s real estate market has more than tripled in value and quadrupled in transaction volume, with a brief dip in 2020 due to COVID-19, and 2025 marking its highest-ever activity.”

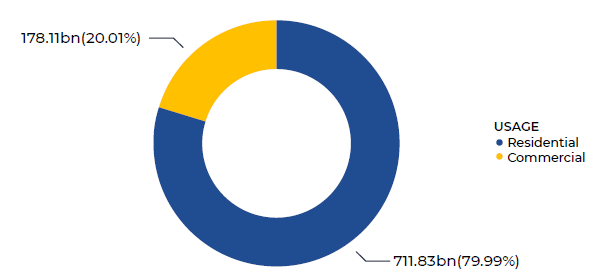

What distinguishes 2025 is not just the scale of growth, but the quality and balance behind it. Market activity remained evenly distributed between ready and off-plan assets: ready properties accounted for 57.6% of total sales value, while off-plan transactions contributed 42.4%. When factoring in mortgages and gift transfers, ready assets dominated overall market value, highlighting deep secondary market liquidity and improved access to end-user financing. Residential assets dominated 2025 activity, representing nearly 80% of total value, while commercial properties accounted for 20%, reflecting strong institutional and high-value investor interest.

What distinguishes 2025 is not just the scale of growth, but the quality and balance behind it. Market activity remained evenly distributed between ready and off-plan assets: ready properties accounted for 57.6% of total sales value, while off-plan transactions contributed 42.4%. When factoring in mortgages and gift transfers, ready assets dominated overall market value, highlighting deep secondary market liquidity and improved access to end-user financing. Residential assets dominated 2025 activity, representing nearly 80% of total value, while commercial properties accounted for 20%, reflecting strong institutional and high-value investor interest.

Figure 2: Market Activity Split by Asset Type, 2025

A clear structural shift also emerged in transaction pricing. The median deal value rose to AED 1.52 million, establishing a higher market baseline and signaling growing preference for quality, well-located, end-user-focused assets. Dubai’s luxury segment remained a core engine of growth: properties priced above AED 10 million generated AED 383.5 billion, accounting for over 43% of the total market, reinforcing Dubai’s appeal as a global safe-haven for high-net-worth individuals seeking capital preservation, lifestyle-driven ownership, and long-term value in a tax-efficient environment.

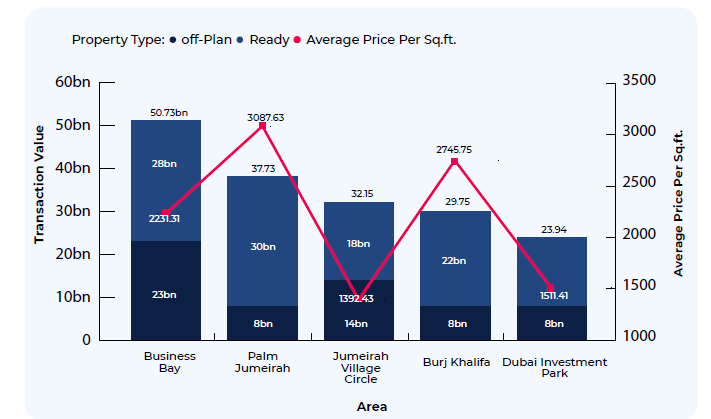

Figure 3: Top 5 Dubai Submarkets by Transaction Value and Volume, 2025

Transaction activity concentrated in high-liquidity, globally recognizable submarkets such as Business Bay, Palm Jumeirah, Jumeirah Village Circle, Burj Khalifa, and Dubai Investment Park. These areas benefited from strong connectivity, lifestyle appeal, and sustained demand from residents and international investors.

Looking ahead, while transaction growth is expected to normalize following several consecutive expansionary years, underlying fundamentals remain firmly supportive. Pricing resilience, selective capital appreciation, and sustained demand in both prime and emerging districts are expected to define the next phase of growth. Opportunities are likely to remain strongest in well-located residential assets, high-quality commercial space, and master-planned developments aligned with end-user demand.

Explore the Dubai Real Estate 2025 Review & 2026 Market Outlook for comprehensive data, trends, and actionable insights across Dubai’s real estate market.

To download the full report, please click below:

Instagram

Facebook

Linkedin

Whatsapp

Phone-alt